Property Valuation Format

Looking for a Property Valuation Format?

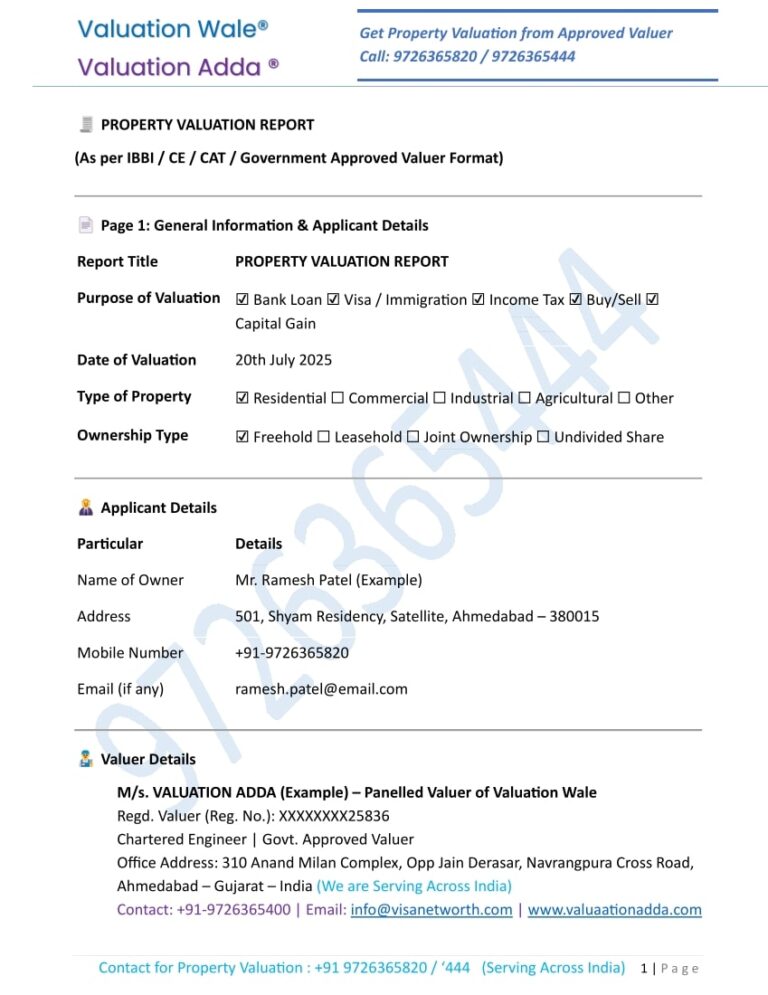

You’ve come to the right place. We have provided a comprehensive guide on how to draft a property valuation format, along with examples and sample copies. Our formats are tailored for various purposes, including visa applications, bank loans, capital gains for income tax, property purchase/sale, and more.

Our property valuation formats are widely used by professionals such as valuers, chartered engineers, architects, real estate appraisers, CA partners, and others. We’ve covered everything necessary for the valuer, end user, and reader of the report.

Each format is prepared in accordance with government-approved standards.

Get in touch with us today for property valuation services designed to meet your specific needs.

- Govt. Approved Format

- Certified by CE

- Starts from Fees: 3500/-

- Get in 3 Hours

Require Property Valuation in Customized Format?

Download - Format of Property Valuation as per Purpose of Usage

Here you can download Purpose and Usage wise Property Valuation Format in Word Format and PDF Format as per requirement. You can email us if you need format for any other purpose as well.

VISA Purpose Format

Buy/Sell Purpose

Bank Loan Purpose

💰 Income Tax Gain

How the Property Valuation Format Differs by Purpose

Yes, the property valuation format often differs according to its purpose. While the core elements remain similar (property details, legal status, physical features, and market value), the depth of analysis and focus areas change depending on why the valuation is being done. Following Industries, User, Stakeholder usage our property valuation format for various purposes with format focused on their goal.

| Purpose | Key Focus Areas / Format Differences |

|---|---|

| Bank Loan / Mortgage | – Emphasis on market value and forced sale value – Details on title clarity and encumbrances – Loan-to-value (LTV) ratio calculations – Typically conservative valuation |

| Buying/Selling | – Focus on current market trends – Comparable sales data – Buyer/seller negotiation range |

| Insurance | – Emphasis on replacement cost rather than market value – Detailed construction specifications and materials – Excludes land value |

| Taxation (e.g., capital gains, property tax) | – Focus on government-assessed value or fair market value at a specific date – May include historical valuation or indexed cost |

| Legal Disputes / Court Use | – Highly detailed and well-documented – Must meet legal evidence standards – Includes supporting documents, assumptions, methodology |

| Rental/Lease Purposes | – Uses income capitalization method – Focus on expected rental income, yield, and occupancy rate |

| Investment Analysis | – Includes future value projections, cash flow analysis, and ROI – May combine multiple valuation approaches (market, income, cost) |

| Government Acquisition / Compensation | – Focus on fair compensation – Considers market value + solatium + rehabilitation cost – Must align with legal guidelines like Land Acquisition Acts |

Key Components of a Property Valuation Format

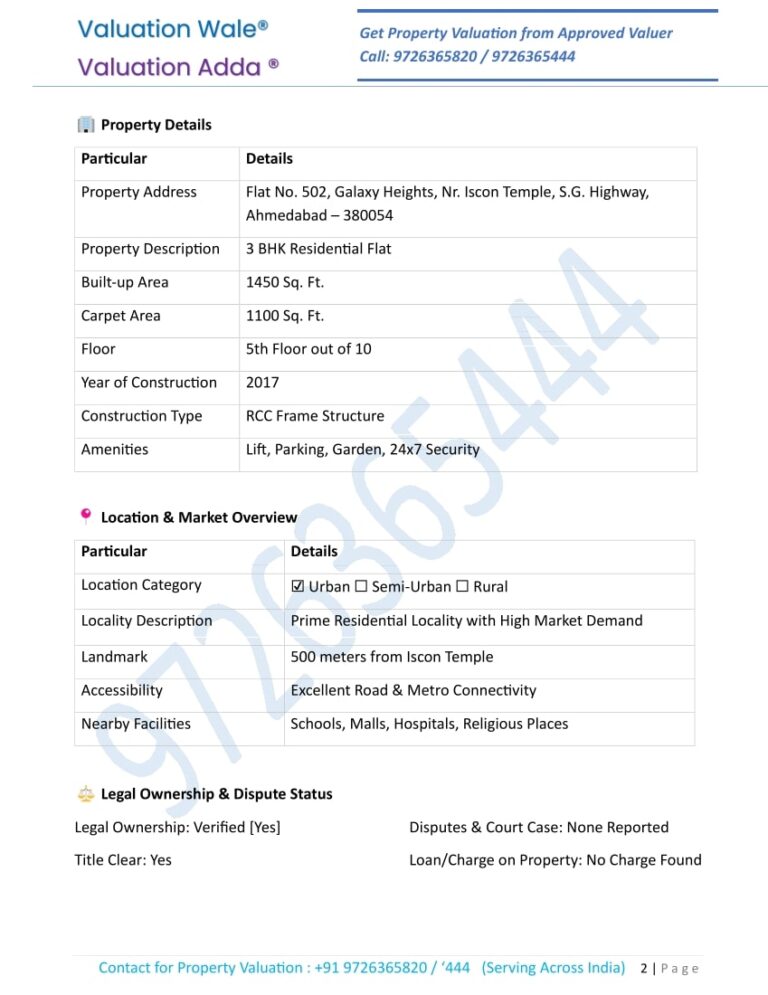

Basic Property Details

Owner’s name

Property address and location

Property type (residential, commercial, industrial, agricultural)

Date of valuation

Legal Information

Title deed details

Ownership status

Encumbrances or litigations

Land use classification (as per local zoning laws)

Physical Description

Land area and built-up area

Construction type and age

Number of floors, rooms, amenities

Site condition and accessibility

Market Analysis

Comparable sales (recent transactions in the area)

Demand and supply trends

Location advantages or disadvantages

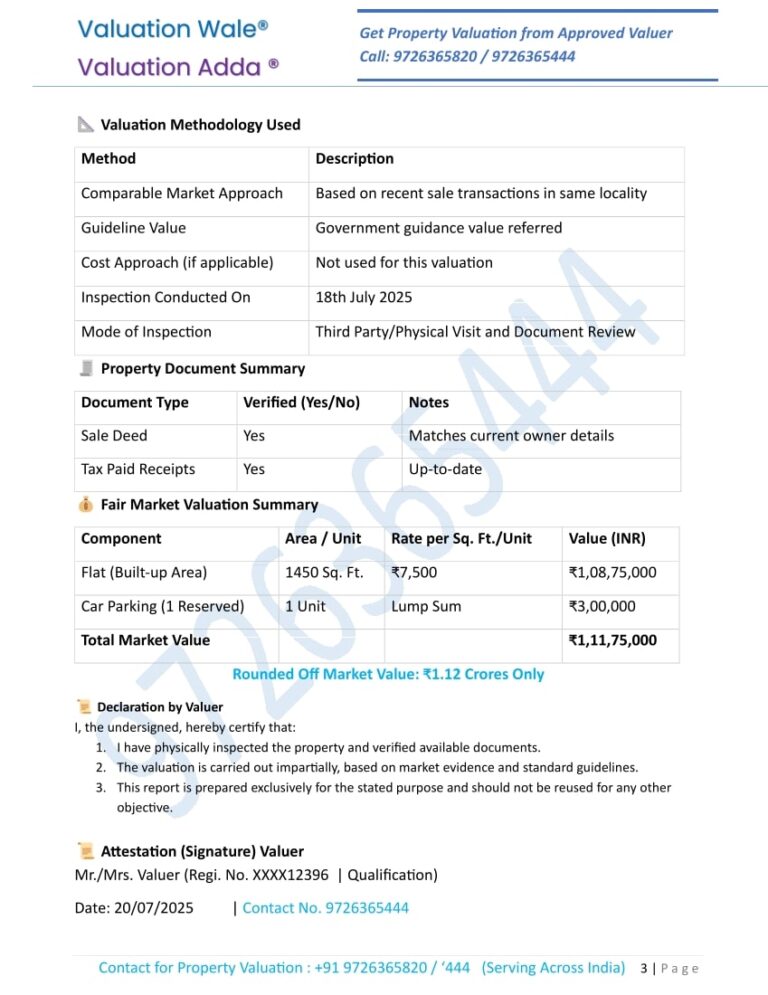

Valuation Methods Used

Sales Comparison Method (most common)

Income Capitalization Method (for rental/commercial properties)

Cost Approach (especially for new or special-use properties)

Value Assessment

Land value

Building value (depreciated replacement cost)

Total market value

Forced sale value (if applicable)

Assumptions and Limitations

Basis of valuation

Assumptions regarding title, condition, market stability, etc.

Certifications and Signatures

Valuer’s declaration

Registration details of valuer

Signature and stamp

Certified Valuer Details & Purpose

Valuer’s Report Date

Purpose and Usage of Certificate

Special Emphasise Matters & Remark (If any)

Print on letterhead

Usage Wise Format for Immovable Property Valuation Report

Based on Usage and Purpose of Valuation, Valuation Report differes little bit. For detailed analysis click on following purpose wise specific format and sample page based on use.

VISA Purpose Format

CA or CE certified valuation reports for Visa embassy & immigration use.

Buy/Sell Purpose

Accurate property valuation to help you determine the right market price for But/Sell

Loan Purpose

Required reports for home loans, business loans, and mortgages purpose (Bank/NBFC)

💰 Income Tax Gain

Property valuation for tax filings, capital gains Valuation Report for Filing Income Tax

Benefits of Using Purpose-Wise Property Valuation Format

Ensures accuracy by focusing only on relevant data for the specific purpose.

Meets compliance with institutional, legal, or regulatory requirements.

Improves clarity for stakeholders like banks, buyers, or courts.

Supports correct methodology based on the valuation objective.

Saves time by reducing unnecessary information and follow-ups.

Enhances professionalism and builds trust in the valuation report.

Fees for Chartered Engineer (Valuer) Report in Purpose Wise Format

As the location of the property is important when quoting the price for immovable property valuation services, we offer our services across India.

Our nearest paneled valuer will conduct your property valuation and prepare the report accordingly.

Our Charges for Property Valuation Services are as follows:

Visa Purpose Format:

₹2500 – West India

₹3500 – North, Central, East & Rest of India

₹4500 – South India

Bank Loan, Fair Market Value, Buy/Sell, etc.:

Starting from ₹8000

Capital Gain (Income Tax Format):

Starting from ₹12,000